Cintra submitted a proposal calling for four new tolled managed lanes on I-76 that would be structured as a $5 billion, 50-year design-build-finance-operate-maintain P3.

-

FINRA found that the firm failed to include the non-transaction-based compensation indicator when reporting 12,066 municipal securities transactions.

December 5 -

The Trump administration is requesting information on revitalizing Dulles International Airport, including the possibility of tapping a public-private partnership.

December 5 -

The Regents of the University of California will sell $2 billion of bonds next week after yanking a $1.5 billion summer deal amid Trump administration threats.

December 5 -

-

The tax-exempt muni market has performed "exceptionally well" so far this week, outperforming USTs, said J.P. Morgan strategists led by Peter DeGroot.

December 5

Dozens of lawmakers are bailing out of Congress before the midterm elections adding new wrinkles to the fading possibility of a second budget reconciliation which could require revenue raisers detrimental to the muni market.

A budget forecast prepared by the Virginia House Appropriations Committee shows tightening financial constraints in 2026 —including a higher cap on state and local tax deductions — could result in the state's issuing bonds.

Bond issuers in the water sector are concerned about a reduction in WIFIA loan closings as some point to competition from municipal bonds as a cause for a decline in their popularity.

Photos from The Bond Buyer's 2025 California Public Finance conference.

Tom Falcone of the Large Public Power Council unpacks the massive infrastructure push driven by AI and manufacturing, and the policy hurdles standing in the way.

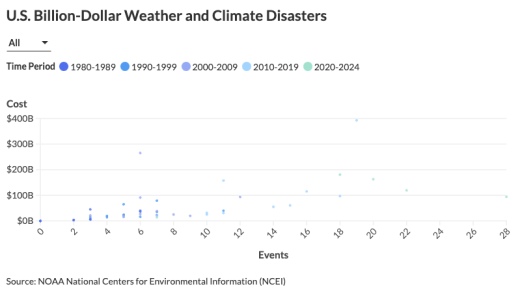

The steady demand for municipal bonds in high-risk areas underscores the complex relationship between climate change and financial markets.

Oppenheimer's Head of Public Finance Beth Coolidge and Columbus Auditor Megan Kilgore delve into the future of public finance and human infrastructure on a wide range of topics, from affordable housing and workforce development to public health, climate resiliency, and digital access.

As extreme weather events occur with more frequency across the country, Michael Gaughan, executive director of the Vermont Bond Bank, says municipal bond banks can help smaller communities deal with the effects of them. Gaughan speaks with The Bond Buyer's Lynne Funk on the effects of climate change and how the various levels of government can work together to address it.

After terminating the project in September, the council approved an initial deal with a new contractor team to develop design and construction options.

The Texas city could revisit plans for a desalination project to boost its dwindling water supply with the city council scheduled to consider it next week.

Concerns over the Texas city's future water supply after a desalination project was terminated, led to negative rating outlooks from Fitch and S&P.

-

Race and sex-based preferences were removed from the state's Historically Underutilized Business program, which will focus exclusively on veteran-owned firms.

December 4 -

As South Dakota becomes the latest Midwest state to consider property tax reform, some officials are scrutinizing school districts more closely.

December 4 -

The Local Government Commission approved bonds for Raleigh, Duke University Health System and Deerfield Episcopal Retirement Community.

December 4 -

The roster change comes as the powerful committee tackles the next surface reauthorization bill.

December 4 -

"The Nominating Committee's goal is to achieve broad representation of the municipal securities market on the MSRB Board of Directors," the committee's chair said.

December 4